Ferriss’ DiSSS Framework Experment

I am currently reading the Four Hour Chef and want to experiment with Tim Ferriss’s learning framework DiSSS (Deconstruction, Selection, Sequencing and Stakes.) So I will catalog it here for all the internet and my many followers to see.

How to Use This Template (if you want it reach out)

Spend 30–45 minutes filling Sections 1–3 before any practice.

Start with a 2‑week sprint; review weekly; adjust one variable at a time.

Keep the Daily Minimum embarrassingly small; protect the streak.

Build and refine your one‑page cheat sheet as you learn.

At the end of 12 weeks, run the Retrospective and write a 1‑page case study of what worked.

Skill: Intraday Capitulation Entry Mastery (timing shorts on climactic moves)

Why now (1–2 sentences): I’m confident in my daily reads, but my intraday entries are inconsistent. I want to refine box + chart timing to reduce frontside losses and catch the turn within ≤2 attempts.

12‑Week Outcome (Definition of Done):

Within 6 weeks, I can enter a capitulation short without a large frontside loss OR, if I miss, I time the trend within ≤2 attempts.

Evidence: logs showing <10K frontside losses on ≥80% attempts; ≤2 attempts per trade on ≥80% of opportunities.

Produce a 10‑rule cheat sheet and an entry checklist with ≥90% adherence on live trades.

Default start cue (time/place): 6PM after the gym - go to turn off my computer.

Pre‑Mortem & Risk Plan

If things go wrong, it will be because… (top 5 risks)

I have not done reviews in the past consistently and need to make sure i stay consistent with them. 2) I will miss on session and give up. 3) I overwhelm myself by doing too much in one day. 4) I will get unmotivated and stop trying. 5) Habit is hard to trigger because its on my trading computer.

If‑Then Rescue Scripts

If I miss a day → I will do 5‑minute micro‑practice the next morning and mark the streak as continued.

If I feel overwhelmed → I will reduce session to one drill, 10 minutes, and cut inputs by 50%.

If tool/access issue → I will run no‑gear variant - watching on my laptop.

2‑Week Milestones (first sprint):

Build a tape set of past capitulation examples

Complete 14 daily micro‑sessions (15 min chartbook + 1 tape rep) and 2 longer sessions (45–60 min): one chart‑only replay block, one box‑only block.

Run 10 sim replays applying Checklist v1; publish baseline metrics (reaction time, entry timing error, frontside loss R) on the scoreboard.

Daily Minimum (Never‑Zero rule): I will do 15 mins chartbook study + 1 tape rep every day post‑close.

Accountability & Stakes:

Public scoreboard: This Blog

Commitment device (money/social): Donate to an anti‑charity= if I miss the Daily Minimum or weekly milestone.

Section 2 — DiSSS Framework

D — Deconstruct

Break the skill into Lego bricks; identify the critical few (80/20).

Candidate Sub‑Skills (brain dump):

Chart trigger recognition (parabolic blow‑off, lower‑high + 1‑min low break, VWAP/anchored VWAP rejections, exhaustion volume, extension vs ATR)

Box reading (T&S/Level II) (bid evaporation, refresh sellers, speed/size, hidden liquidity tells, imbalance swings)

Entry checklist + If/Then rules (confluence minimums, two‑probe max, bracket orders)

Exit playbook (systematic vs discretionary, partials, trail after 1R, capturing the backside trend)

Risk & sizing (A+/B keys, structure‑based stops, R‑based sizing, frontside loss caps)

Tool selection minimalism (trendlines, anchored VWAP, key levels; avoid indicator bloat)

Context (SSR/halts mechanics, liquidity/float regime, time‑of‑day filters)

Sim/replay skill (accurate fast execution in replay to test PnL effect)

80/20 Scoring Table (Impact: 1–5; Effort: 1–5; Priority = Impact ÷ Effort)

Prerequisites / Key Terms to decode first: Frontside vs backside; ORB; LOD/LOHOD; VWAP/anchored VWAP; exhaustion volume; SSR; halt up/down; MAE/MFE; liquidity vacuum; “stuff” move.

Common failure points to avoid: Doing too much in one session → keep it short & winnable; chasing first push without confluence; widening stops; revenge‑probing >2 times; letting entertainment distract—use temptation bundling only after warm‑up (e.g., Naruto during annotation, not during decision reps).

S — Select (the Minimum Effective Dose)

Choose the least you can study that gets you 80% of results.

I will select the best personal tape recordings I have starting with short capitulations as I believe that will be most actionable for the coming weeks and months in this market.

Short Capitulation Curriculum:

SMCI 2-16-24

MSTR 11-21-24

NVDA 3-8-24

DJT 10-29-24

FFIE 5-17-24

GME 5-14-24

OPEN 7-21-25

CRCL 6-23-25

S — Sequence (short, winnable loops)

Order sub‑skills from easiest‑to‑win → most complex; interleave for retention.

Learning Path (first 4–6 steps):

Label tapes → 2) Build 10‑rule cheat sheet (v1) → 3) Chart‑only replays → 4) Box‑only replays → 5) Integrated sim replays w/ brackets → 6) Live small‑size w/ strict two‑probe cap.

Weekly Cadence:

Mon/Wed/Fri = Box‑only or Chart‑only drills (15–20 min) + 1 tape rep

Tue/Thu = Integrated drills (20–30 min) + screenshot annotations

Sat = Sim challenge: 3 replays

Sun = Review + plan next week (20–30 min)

S — Stakes (make it hard to quit)

Public commitment: Post weekly progress + metrics on my blog scoreboard.

Financial/social stake: Donate to “One for Israel” if I miss the Daily Minimum or a weekly milestone; post proof.

Visible scoreboard: Blog table with Minutes studied, Tape reps, Check‑list adherence %, Two‑probes‑or‑less %, Frontside loss (R), Net R/trade.

Section 3 — CaFE Accelerators

C — Compression (cheat‑sheet the skill)

Core rules / heuristics (max 10):

Confluence minimum before first short: parabolic push + exhaustion volume + failure to make new high and micro‑structure break or VWAP/AVWAP rejection.

Box confirm: bid evaporation or obvious refresh seller near the turn; no persistent sweepers lifting offers.

Two‑probe max: if Probe 1 fails, Probe 2 must show stronger confluence or better price—then done.

Bracket on entry: stop = last push high (or structure); never widen.

Time‑of‑day filter: prefer open → first 90m and power hour; avoid lunch unless exceptional.

Frontside loss cap: average ≤0.3R; abort if tape contradicts.

Exit archetype A (trend): partial at 1R, trail above LHs/AVWAP; Exit B (flush): take 70–100% into capitulation wick.

Liquidity rule: avoid illiquid traps; require clean prints and depth.

SSR/halts: adapt entries to pop‑into‑bids behavior; avoid first candle post‑halt unless rule‑fit.

Log every trade with annotated screenshot & checklist result.

If‑Then rules (for common situations):

If price makes a parabolic push with a volume climax, then wait for a lower‑high and a 1‑min low break with box bid fade → short; risk = last push high.

If Probe 1 stops and next push is weaker (lower high + lighter volume), then prepare Probe 2 on micro‑break; else stand down.

If box shows persistent sweeps lifting offers, then do not short; wait for that behavior to stop.

If trade reaches +1R, then partial & move stop to breakeven/structure per Exit A/B.

Glossary (jargon → plain English): frontside/backside, ORB, LOD/LOHOD, SSR, exhaustion volume, “stuff” move, AVWAP, MAE/MFE, bid evaporation, refresh seller, liquidity vacuum.

F — Frequency (never‑zero + reps)

Baseline Daily Minimum: 15 min + 1 tape rep post‑close.

Habit stack: After I close my platform, I will start a 15‑min timer, open my checklist, and do 1 tape rep.

Session structure: 2‑min warm‑up (cheat‑sheet review) → 10–15‑min drill → 3‑min log.

Spacing plan: Daily micro + 2 longer sessions/week + weekly sim challenge (Sat).

E — Encoding (remember faster)

Analogies / metaphors: Don’t catch the falling knife—wait until it sticks in the cutting board (lower‑high + break) and grab the handle (box confirm).

Memory hooks: C‑B‑B = Climax → Break → Box‑confirm; T2 = two‑probe max.

Feynman 3‑step: Teach the checklist to a novice; record 3‑min explainer; note any fuzzy steps; simplify.

Week 1

Environment Design (make good habits easy, bad ones hard)

Remove: phone/notifications during 15–20 min block; hide social tabs.

Add: timer + checklist pinned; replay hotkeys; playlist; temptation bundling allowed only during annotation (e.g., Naruto muted/subbed), not during decision reps.

Default start cue (time/place): Post‑close at desk; start timer immediately after logging out.

Deliberate Practice Session 1

Session Goal (specific skill & standard): Select the most important capitulation trades to study - tag them - rank them - and categorize them based on your setup framework.

Timer / Reps: 15–30 min

Reflection (2 min): What improved? What to change next session?

Notes:

Successfully have a folder with 8 top tier capitulation trades and I will study them in depth. The selection stage is done for this round. Itll need to be done again to select the long capitulations. One thing I noticed is that I dont have the recent recordings of Kohls which would’ve been nice and OPEN in the afternoon before the LULD. Definitely need to think about the importance of building this library going forward. Its pretty interesting comparing my 2023 recordings to 2024 and seeing the opportunity set there. Way more long capitulations and selloffs vs 2024 with short capitulations. We’re in another one of those markets.

Deliberate Practice Session 2

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Enter at 09:42:34 where ideal entry in my opinion is 09:42:43 so slightly early. Still a very good entry in my opinion.

Failed breakout / Premarket high test gave me confidence post open chop / NVDA weak

Reflection (2 min): What improved? What to change next session?

Notes: Pre : going to try the short trigger call since I haven’t reviewed this tape in a while and don’t remember SMCI well. Starting with the best.

During: Cant type up any other tickers if there is an A+ opp on the table.

I know it doesnt bottom off the open so this isnt getting me but it really did look weak off open iwth NVDA confirming too.

Huge spike off lows showed counter move at 9:33

After: Im pretty happy with my performance here. What this teaches me is that over time we forget how choppy an A+ best capitulation trade of all time can be. Off the open this stock acted like it was going to break down immediately, opened at lows, then kept trending lower for 2 mins before reversing and squeezing hard. Over time, I’ve built up this narrative in my head that SMCI was amazing, easy, obvious, etc. yet it was just as hard as every other one - it just went more and cleaner than any other trade like it. Ill remember that the next time Im preparing for a trade like this.

The entry was also faily straightforward if you avoided the opening chop fest. It came right up to premarket highs, consolidated below, then tried to breakout, stuffed, and broke the trendline that formed before breaking down and starting the down trend. Obviously I knew to avoid the hardest part (I knew it didnt top until after the open but it still gives me confidence that I can time these well.

Deliberate Practice Session 3

Session Goal (specific skill & standard): Find signals for the squeeze off open - I want any big buyers, box action like algos, etc.

Drill(s):

Box‑only drill: spot bid refresh/offer pulls at turn off open t rap; timestamp & screenshot.

Timer / Reps: 15–20 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Screenshots with identificated buyers / sellers

Reflection (2 min): What improved? What to change next session?

Notes:

There wasn’t even such large bids showing or huge print sizes on the prints window - it was just spray type action at the offer thatt widened the spread and caused jittery shorts to panic out after two failed breakdowns.

Bids keep coming up and filling the spread. Particularly noticable when it failed and spread was 1033 by 1040 - bids came up vs other way. 9:33:20

Then you can see very strong bids where ticks are going off at the bid yet its not budging. Specifically at 9:34:20 at 1050

at 9:49:50 - you see MWSE walking up a bid seemingly to test and see if anyone hits it - gets slammed right near lows.

9:50 it breaks lows - key moment here - doesn’t get a chance to retest. You get one of those boxes that feels so stuck and weak.

Improvement - I learned that you can learn about a stock based on what it does near lows - difference between the open vs when it actually broke. The bids came up to fill the spread but were smacked.

Deliberate Practice Session 4

Session Goal (specific skill & standard): Watch and study the box during the downturn and down move. Want to compare to yesterday. Skill would be to identify when the trend lower is definitely on and weak.

Drill(s):

Box‑only drill: spot bid evaporation/refresh seller at turn; timestamp & screenshot.

Timer / Reps: 15–20 min

Immediate Feedback Source (coach/video/checklist):

Score / Pass‑Fail: Pass if able to list 3 tells.

Reflection (2 min): What improved? What to change next session?

Notes: Fails to test low of day break level of 1025 at 9:51 and stops at 1020. 1000 level break very key - you see huge flushes with bids dropping 10-20 points in seconds on 150K volume bars. at 9:54 you see some counter trends with 30K bid tested at 950 and bouncing off that level with a 20K bid coming high at 955 - fails so incredibly fast.

Below is a picture of a 20k bid being wiped at 950 after 30k bid soaked and 20k at 955 soaked. Clear weakness shown by bids being taken

11K wiped in one swipe - book cleared to 941.

These massive 20K NSDQ bids keep getting wiped - minimal countertrends - no fighting.

9:59 - you had the 20K at 925 get wiped, then spike back up but even that fake out short trap fails lower = true weakness.

Mostly, seeing huge chunks of stock get soaked provides confidence that this trend is still very much on and no where near completion.

I learned that you must be taking stock of the trend as it goes and gauging strength and weakness of it - there are scales - how much volume? how much box activity? size of bids and offers? In this case you saw huge bids get soaked and absorbed by the selling in the market, you saw huge bursts of selling and minimal bounces, you saw huge activity and volume in the box once the 1000 level gave out.

Deliberate Practice Session 5

Session Goal (specific skill & standard): Go over the break of 900 and the counter trend. Try to identify the counter trend within 30 Seconds.

Drill(s):

Integrated sim: execute exit

Timer / Reps: 15–20 min

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Reflection (2 min): What improved? What to change next session?

Notes: My exit was successfully within 30 seconds of the bottom - wihtin 10 seconds in fact. Saw it consolidating on a level (870) and once it broke it trapped then broke back above that level. It didnt immediately break the 2 min but eventually did and started a counter trend to 920 before failing.

I havent looked at this tape in months so the fact that I nailed it feels good.

Deliberate Practice Session 6

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk. Doing MSTR now.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Shorted at 9:49:58 -basically right as the prior 2m breaks on huge volume that comes and whipes bids clean down from 530 to 525. I think this is a great entry as its right as the move starts to get going to the downside after 20 mins of consolidation below vwap. Clear selling at 530 and this is where it starts to peel away on volume. PASS.

I’m seeing that none of these are easy again - they all chop, mess around at key levels, the only commonality is that they fail and they fail fast. They do the fake out moves like break lows, trap shorts and come back into range, the commonality is that they fail back quickly and where these patterns emerge. In SMCI the fakeout break low signified change of trend after a 200 point move, but on MSTR that was a fakeout.

Deliberate Practice Session 7

Session Goal (specific skill & standard): Find signals in the box - I want any big buyers, box action like algos, etc. MSTR

Drill(s):

Box‑only drill: spot bid refresh/offer pulls at turn off open trap; timestamp & screenshot.

Timer / Reps: 15–20 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Screenshots with identificated buyers / sellers

Reflection (2 min): What improved? What to change next session?

Notes:

Learning that the prints window is very instructive. You can see huge buys and sells that come in streaks showing up in the prints window. It helps you confirm trends and get a feel of how aggressive the selling is.

An example of the prints window showing streaky selling right at VWAP

Prints window example with streaky action to the upside on the open squeeze to VWAP

Great example of heavy selling at VWAP with all prints at the bid.

Offer was at 531 a second ago - you can see in prints window the offer wipes all bids down to 528 leaving 12.5K shares left at 528. Large seller identified at VWAP.

Noticing these things in the moment can be tough but instructs your confidence on the fact that this will trend lower. This was a change of character for MSTR with selling at VWAP vs trappy and squeezy aciton on the days prior. Being able to see the streaky selling / stuffing at VWAP / large offers coming low can reinforce the idea that this is the time to get short this name especially with the 11% gap up in the name.

Deliberate Practice Session 8

Session Goal (specific skill & standard): Find signals in the chart

Drill(s):

Chart‑only drill: watch for chart patterns in the setup off the open

Timer / Reps: 15–20 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): 1-3 Chart Tells

Reflection (2 min): What improved? What to change next session?

Notes: One tell is the tightness at 530 while BTC is rallying - chart compresses before it can pick a direction. Another is the large close at lows type of bar that consumes prior bars - shows the trend. Building volume - expanding bar ranges. All key to trend confirmation.

What to change - next time try to come back to the desk refreshed - can’t today because its friday and have a rehearsal dinner but not ideal to study distracted and tired.

Sprint Retrospective 9/28/25

What outputs did I produce? (videos, tests, performances):

I produced screenshots of large bids, offers, of the prints window patterns that tend to correlate with price action. I tested myself on the short and the long in terms of telling when the best entry is before the move starts, when the best exit is after the move has happened. I was better able to do so on SMCI as I had the whole move saved.

8 days down, 195 minutes and 2 trades deeply reviewed. Spreading it out over days makes it much more palatable. I feel quite committed to this project too especially in this market.

What rules/heuristics actually mattered?

Wait for Weakness - Below VWAP - to short

Seeing these playback its so crazy to see how much room these had to go - you could’ve shorted 50 points off the high on SMCI and still made 200!

The key tells are the bursts of selling and price has to go down to see that happen.

9:45AM + helped avoid the squeeze moves off the open on the first two tape replays.

Failing Fast - I’m learning that all of these trades were hard. None of them opened, waited 15 mins, then sold off in a straight line. The ones I watched were choppy, stubborn, had fake out moves, tested you, broke key levels, and made it really hard prior to the big move. The commonality is that they failed fast. MSTR squeezed off the open and broke VWAP but was back below within a minute. SMCI would chop around, test you, but fail fast. So if you feel tested- think in your mind - “this should fail fast”.

When an A+ opportunity is on the table, do nothing else (“can’t type up other tickers if there is an A+ opp”).

What will I simplify or cut next sprint?

I think I could focus on running through each tape recording to test my intuition on when to short -that is the one test I find most useful and itneresting. What are the signs I’m looking for, how can I refine that, what is my intuition seeing thats leading me to want to short here? I think these questions make me better for the next one. Its the closes thing to actual trading drills I’ve felt.

Something to keep in mind for future taping of opps is to capture the entire setup beginning, confirmation and the end of the trend. Those 3 moments are most important to study.

Next sprint focus:

Timing of entries

Box and Print signals at the time of those entries.

Confirmation signals to improve confidence at the time of these trades.

One Idea for later - Speed up the tape after reviewing all of them for quicker identification and harder testing.

Overall, this exercise has been very useful so far. i can see that I am improving my feel, the things I focus on, my confidence and hopefully the next time we get a capitulation trade - I’ll be able to use my learnings. These trades are so few and far between that it becomes tough to remember all the lessons from the last one. This is the best way I’ve seen so far to keep you refreshed for the next one and on top of your game.

Deliberate Practice Session 9

NVDA 3-9-24

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Reflection (2 min): What improved? What to change next session?

Notes:

Short NVDA at 10:32:30 - with the benefit of hindsight and remembering the signals here I can say that the short should come as BTC broke out on insane volume 1M shares in 2 mins then failing all times highs as a sign of risk sentiment. Blow off moves in many names with COIN, AMD, and MSTR up 10% each. You had NVDA up 5% after making a massive run. The crack in risk sentiment here aligns with 2 min break on NVDA after a morning euphoric push to highs doing about 50% of ADV in an hour. risking about 4 pts to highs and IBIT follows through very well bsaically retracing full daily move in seconds.

Added bonus top signal - I sold all my 0DTE puts during the NVDA euphoric second leg to highs.

With the ideal trigger being 2 min break coinciding with BTC selloff at 10:32:03 I pass since its within 30 seconds of ideal trigger.

10:35 is key as NVDA makes push back to highs and puts in lower high -> then two consecutive lower highs as confirmation

Looking back at this day its clear that everything about it made you want to give up - it chopped around off the open after gapping 2%, made a clean move higher, broke 2 min bar then broke highs again and all the moves were sharp yet steady. Never showing super capitulatory volume in any 2 min bars. The moves here were designed to make you give up then right when that happens it’ll go.

Deliberate Practice Session 10

DJT 10-29-24

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Reflection (2 min): What improved? What to change next session?

Notes: I missed the opening short so FAIL - The ideal spot was right after the open around 9:31 where it bounced after breaking premarket lows, trapping shorts, and got absolutely whacked at 53. Note that the move ended up bouncing pretty hard but still a good open scalp type move. 2 min bar may have captured about 1.5 pts. Pre 9:45 = scalp mostly.

Incredible that you can actually still have a chance to get the ideal entry and still miss it even though you’ve seen it before. DJT out of halt was so fast I completely missed the short. Ideal entry was out of halt - shorting print, then adding into the spray lower. You only had a few seconds. It was gone to limit down so fast. Have to remind myself how much meat is still left on the bone here. 9EMA was at 40.

Ideal entry basically 9:41:41 to 9:41:48 so 7 seconds and you had a spray move to 53.60 where offers would’ve been incredible. Another example of how hard these can be. Nice setup off open - looks like its going to go, squeezes everyone back to limit up at 54.09. Opens higher limit up at 54.50 then smacks down in seconds to low 53’s, tests 53.60 before failing to limit down at 51.50 after 9 seconds of trading!! Need to be extremely decisive in these moments. Then again it went down to 48 and squeezed back limit up to 52! I watched 2 huge moves and still didn’t miss the ideal entry. I get a third chance to get in for the big move. Mindset couldve been here that the stock still is 10 pts above 9ema and much room to the downside.

Entering at 10:12:26 - Tight inside bar - its at 50 after breaking the prior low of the bar. Ideal entry at 10:15:05 though as 50 gives way and the larger move starts. I failed and this was a very hard trade to time and manage. Huge volume spike then and clear fails on the stock.

For these types of trades you need 1. an imagination to think about how far these things can really go so you can accurately estimate EV and stick with an opportunity 2. flexibility to avoid being stubborn and getting run over 3. confidence and conviction to avoid being scared by the inevitable tests of confidence and 4. a clear mind to listen to the chart and box to identify those moments to get in and avoid the churn.

Ideal entry may have been around 49.50 - yes much lower than where most would think - because that was when the trend confirmed. You had a huge volume spike on break of 50, an attempt to squeeze and come back like times before but a lower high put in as it failed leading to the trend lower.

Lesson: Ideal entry should be defined as one that lest you capture the meat of the move by timing the start of the trend rather than selling tops and covering bottoms.

RGTI 10-7-25

This project alone could be paid for with one well traded reversal trade and it almost came today on RGTI. Because I just studied the NVDA top where the stock broke out and failed during a 10-11am push, I had the “this looks like NVDA” realization for RGTI. Similar pattern where they’re both on their 3rd or 4th day higher, chop off the open, trap shorts, then make a push during the 10-11am session where they consolidate tightly at highs before breaking out and reversing.

It instantly clicked and I shorted RGTI riding the trend lower before giving most of it back during the chop at lows of day. Got over zealous but I think thats a big win seeing the immmediate impact from this project on my actual trading.

Lesson here: When it comes to capitulation and momentum trades the best EV is early, the best prints are early, and you need to be willing to size it early and with confidence. RGTI was one where you needed to size at 45 or 44 break or else the trade really wasnt that good. I waited too long to do so

Deliberate Practice Session 11

FFIE 5-17-24

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Reflection (2 min): What improved? What to change next session?

Notes: Short at 11:34:11 on 2 min break, trend line break, after morning consolidation and euphoric 30% move higher. Ended up breaking hihghs after so FAIL.

This thing broke prior 2 min and squeezed back to highs - totally forgot that this happened.

Best entry in my opinion is at 12:45 where you had multiple fails and level breaks with failed follow throughs to the upside putting in lower highs. Also had that sharp price and vol spike into range that could spook some people.

Best EV entry prob at 12:33 when 3.5 gave way after bouncing off of it a few times.

This is an extremely hard trade in hindsight as the top was really choppy, trappy, and broke highs. Another good reminder how difficult these tops can be and how over time we just remember how good each trade was not how hard it was to catch.

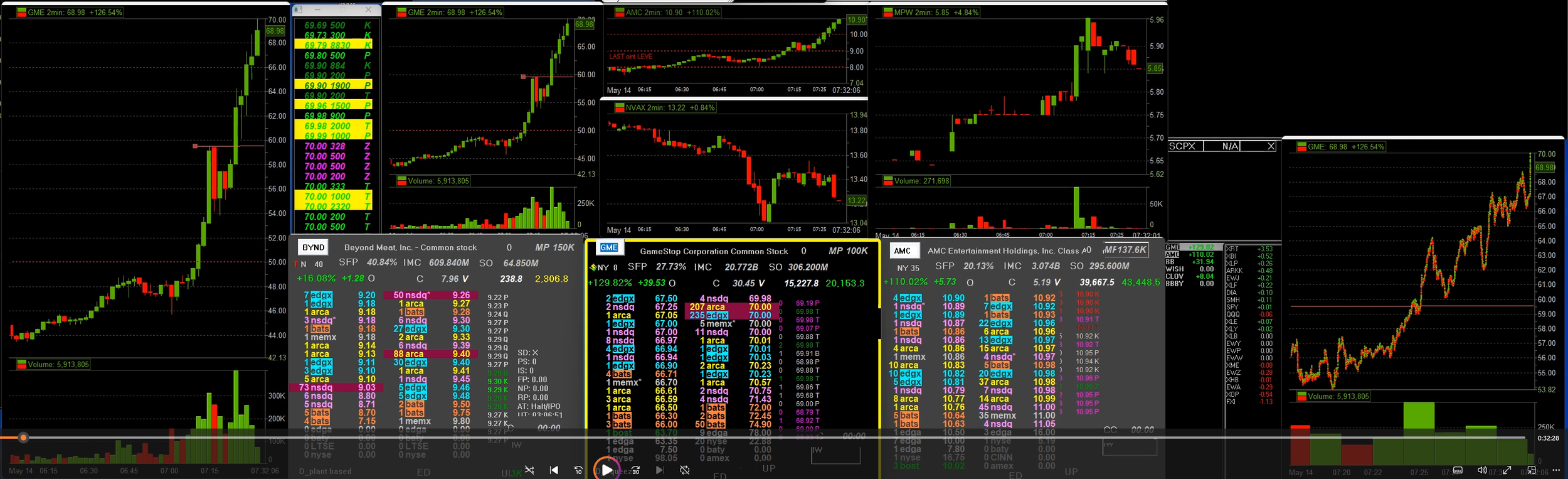

Deliberate Practice Session 12 GME 5-14-24

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Reflection (2 min): What improved? What to change next session?

SS at 7-38-36 because you had range expansion on 2 min + clear over extension over top trend line - stuff at 80 - then fail + lower high put in as a fail of trend line. Want to be sure its right side on something like this.

Perfect add spot at 7-50-15 when it fails 78 after getting rejected at 80 with large offers. A classic double top type setup.

When it comes to whether I passed of fail - I technically failed. However my entries made sense initially and I think I wouldnt change the system involved in my thinking. It never broke highs so i risked 5 pts to make 20 or so. Then it setup for a great spot to add. Just important to acknowledge my psychology likely wouldnt have been great in this moment as drawing down to your out in a squeezer name in the premarket is definitely scary. But everything works out here and my entries had good logic both times. Satisfied with the result either way

Main lesson is that these dont work out how you think they will and it emphasizes the importance of being psychologically flexible and knowing that your systems account for this flexibility. Market doesnt care about your entry price or how you feel. Need to be able to draw down to trade these well sometimes.

To note - the two screenshots below were the start of the squeezey move above 70 where some bid came high to wipe the book straight up.

Deliberate Practice Session 13 OPEN 7-21-25

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

Pass -SS at 15:19:30 while ideal entry is at 15:19:50 when Open is infront of $4 level after the spray test.

Reflection (2 min): What improved? What to change next session?

SS at 15:19:30 - Trigger being the third test of $4 resistance through one of those “i give up” type of sprays that so often signify a turning point.

After the spray to 4$ you see the stock start the trend lower. It makes a weak push higher before breaking 3.90 and flushing down. See Below.

To begin the trend lower you have large 174K bid get wiped all the way down to 3.84

aaaaaaand its gone. Prior 2 min low gets broken seconds after.

Deliberate Practice Session 14 BYND Review 10-22-25

I want to do something a little different this time since there was a trade that so resembles what I am looking to capture by doing this today. It was very fortunate that I studied OPEN yesterday as BYND was extremely similar - not exactly the same but similar. I was able to use lessons from the tape and apply them to BYND leading to a great trade today.

Off open BYND went limit down and I’m proud of myself for not feeling FOMO, not needing to trade it, and letting it come to me because it set up so much better later in the day.

My initial short on the 5.9 break at 9:50 made a lot of sense - you see this U shaped pattern off the open a lot and there was clear weakness in the name. You see pretty aggressive buying at that 5.5 level after a battle right on 5.5 seeing huge prints and streaks of prints at the bid then the ask and ultimately the stock ends up higher.

When it comes to the actual move - I only have tape after the limit down on the right side.

I think I could’ve been thinking that we are now below vwap, its at 6.20 but the potential rewarrd is best case a gap fill at 3.5 or 4.5 on the breakout level test from the post market yesterday. So that is 1.7-2.2 potential reward, risking to 6.50 so about 3/4:1 and pretty high confidence backside since we just failed vwap.

At the time, I didnt want to ruin my average price which was at 6.64, I wasn’t super confident this could collapse given all that chop off the open, and figured I was happy with the size I had. But adding in that spot was the difference between this being a great trade and an amazing trade from an execution standpoint.

Shorting the 6.1 break where the prior 2 min bar low to the downside gives was probably the simplest execution, can risk to 6.40 ish so 35 cents to make 1 pt to 1.5 pts depending on how it plays out. See below.

Deliberate Practice Session 15 CRCL 6-23-25

Session Goal (specific skill & standard): Call and execute the short trigger within 30s of confluence on replay; place bracket with ≤0.3R risk.

Drill(s):

Integrated sim: execute entry with stop/target; log MAE/MFE.

Timer / Reps: 15 min; 1–3 reps per session.

Immediate Feedback Source (coach/video/checklist): Self‑review with checklist + screen recording; compare to “ideal trigger” timestamp.

Score / Pass‑Fail: Pass if entry within 30s of ideal trigger; else fail.

short at 11:28:03 because you had a strong 20 point move, sharp push and fail, neckline break is the trigger + trendline break + prior 2 min bar low break. Risk to highs or 300.

Pass - the ideal trigger was right there, you get some test as it comes back above the neckline along with a sharp fake out move but risk has to be to highs and those never break.

Could also add when the 290 neckline breaks.

Reflection (2 min): What improved? What to change next session?

I feel a little phony saying I crushed this session because I remember CRCL pretty well and remember when it topped but the signs were there.

One realization I had this morning is that you have incomplete information. Everything is clear in hindsight but you never know how all the participants are going to react. My job is to follow my rules which are developed by learning from experience and using my incomplete information to make the best decisions I can in the moment. I cant be sure this will go immediately, but I also can’t be sure its going to break the neckline then rip back to highs either. I take information as it comes and can be even more confident that this is going back to VWAP when it fades from the high test.